What is Authorized Push Payment (APP) Fraud?

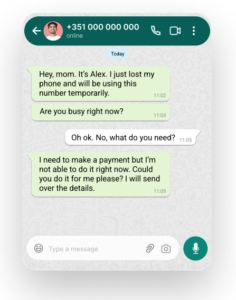

Push payments refer to any situation in which a payer initiates a transaction, and sends or “pushes” money to a payee. Fraud occurs when criminals deceive individuals or businesses into believing they are a trusted party (a son, a bank, or even a government agency), leading them to send money from their bank account directly to the fraudster. Unlike unauthorized transactions where the fraudster gains access to someone’s bank account without permission, in APP fraud the victim authorizes the payment.

Push payments refer to any situation in which a payer initiates a transaction, and sends or “pushes” money to a payee. Fraud occurs when criminals deceive individuals or businesses into believing they are a trusted party (a son, a bank, or even a government agency), leading them to send money from their bank account directly to the fraudster. Unlike unauthorized transactions where the fraudster gains access to someone’s bank account without permission, in APP fraud the victim authorizes the payment.

These practices have become more and more sophisticated over time, with fraudsters becoming experts in manipulation tactics to convince victims into making the payments, exploring emotions such as fear or sympathy and providing false information to gain the victim’s trust.

A Growing Threat

Despite the efforts of prevention by alerting potential victims of the common scams, APP Fraud has been a growing concern for all – individuals, businesses, banks and Governments.

In the UK alone, APP fraud losses reached £485.2 million in 2022, according to UK Finance the trade association for the UK banking, with case volumes breaking 100,000 for the first time. Overall, the amount of APP fraud losses reimbursed increased by five per cent in 2022 compared to the previous year. Additionally, a study conducted by UK Finance concluded that 18% of fraud cases originate via telecommunications, and these are usually higher value cases, such as impersonation fraud, and account for 44% of losses. If we use the same proportion for fraud losses in Europe, which amounted to € 1.77 billion, according to the European Commission’s 2022 Annual Report on the protection of EU’s financial interests, this would imply a potential of € 779 million losses to APP fraud.

What is now a brand reputation and customer loyalty problem for Financial Institutions, will very soon be a financial one as Governments adopt measures to protect the consumer. In fact, Retail Banker International reports that UK banks paid for 43% of customer APP fraud losses in 2020, amounting to £207 million, but still, the UK Government finds that the reimbursement of victims remains inconsistent, with many victims still suffering. Although victims of unauthorised fraud cases are legally protected, with UK Finance estimating that 98 per cent are fully refunded, in APP it was not the case until now, which is why the Government has been discussing the introduction of that requirement from 2024 onwards, setting the example for other countries to put pressure on Banks to adopt a more active role in stopping APP fraud.

Money Mules

Money Mules (MMs) are individuals who are recruited, often unwittingly, by criminals or fraudulent organizations to transfer illegally obtained money between different accounts or jurisdictions. As with APP fraud, scammers in MM scams can resort to social engineering and manipulation techniques to trick individuals into receiving and transferring funds with illegal origin, keeping a portion to themselves as payment.

A Pressing Concern

For Financial Institutions and, in particular, banks, tackling MM fraud is very important because they are held liable for the transfer of illicit funds and face the risk of paying both severe fines and sanctions for failing to adequately monitor and prevent illicit transactions, or the reimbursement of victims, impacting both financial stability and reputation.

We’ve seen several cases of the consequences of this throughout the years, such as HSBC agreeing to pay $ 1.9 billion fines to the US authorities in 2012 for failing to prevent money laundering activities, including facilitating transactions for Mexican drug cartels and processing transactions involving money mules. ING Bank, in 2018, being fined in € 775 million by the Dutch authorities for failing to comply with anti-money laundering regulations and not adequately scrutinizing customer transactions, including those involving money mules. In the same year, Danske Bank becoming embroiled in a massive money laundering scandal involving its Estonian branch, facing regulatory scrutiny, legal investigations and significant reputational damage as a result of the scandal and agreeing to forfeit $ 2 billion as part of an agreement with the US’s Justice Department to which the former said it will credit $ 850 to resolve the SEC and Danish probes.

As such, it is crucial for Banks and Financial Institutions to adopt effective fraud detection mechanisms, freezing and reporting the involved accounts.

Fraudio‘s role in supporting Banks fighting these types of Fraud

To combat APP and MM scams, financial institutions need to top up their game in several dimensions where AI has a huge potential of enhancement, enabling to better protect their customers and safeguard against financial crime:

– Implementing real-time transaction monitoring: firms should adopt systems that continuously analyze transactions as they occur, allowing for swift identification of suspicious patterns or anomalous activities. AI-powered fraud detection systems can monitor transactions in real-time, enabling immediate detection and response to suspicious activities. By leveraging ML models trained on historical fraud data, these systems can continuously adapt and improve their ability to detect emerging fraud patterns and tactics.

– Exploring behavioral analysis: understanding the typical user behavior in order to identify transactions that deviate from the norm. AI can analyze the behavioral patterns and detect sudden changes to spending, login locations or transaction timings that may indicate account takeover or unauthorized activity associated with Money Mule schemes.

– Growing data intelligence: using vast amounts of data to identify and learn from new fraud tactics as they emerge. AI algorithms can analyze large volumes of transaction data to identify complex fraud patterns – unusual payment amounts, frequency or recipient accounts – and adapt to new fraudulent schemes, improving fraud detection accuracy over time.

– Collaborating with other market players: AI-powered fraud detection systems can facilitate collaboration and information sharing among banks and financial institutions to identify and mitigate cross-institutional fraud schemes. By pooling data and insights from multiple sources, AI can provide a more comprehensive view of fraudulent activities and enhance the effectiveness of fraud prevention efforts across the financial system.

Fraudio’s mission is to connect merchants, payment service providers, merchant acquirers, card issuers and other players in the payments chain to a powerful centralized AI / smart brain that prevents, detects and fights fraud in real time, creating unrivalled value. It’s differentiation against APP scams and Money Mule activities lie in both its comprehensive suite of products and its centralized dataset, which make Fraudio the all-encompassing partner in the fight against these criminal activities.

We’ve been proud investors of Fraudio since 2021 and continue to be very excited about its role in the fight against fraud. Feel free to reach out if you’d like to meet them!

By: Matilde Limbert, Principal